After four and a half years of posturing, politicising and a nation divided, the Brexit deal finally came at the 11th hour. The agreement has provided much clarity, but it marks a significant change to the way that we do business with the rest of the world and we haven’t heard the last of Brexit yet – negotiations continue on some key issues – particularly around mutual recognition, and the legal system surrounding it now needs to be written.

In this article we do a quick round-up of the implications of the agreement on the finishes and interiors sector, looking particularly at the movement of products and people.

Movement of products (watch out for rules of origin)

It is true that the United Kingdom and the European Union have agreed to unprecedented tariff liberalisation. There will be no tariffs or quotas on the movement of goods that we produce between the UK and the EU, but the vital word here is ‘produce’. What the scope of this agreement does not enable is free movement of products that originated outside of the UK or EU. If you are re-exporting a product or component or rely on an assembly with parts that originate outside of the EU, this may mean tariffs do apply. This won’t cause problems on systems (e.g. door sets) that incorporate product from outside of the EU or UK, but may cause some issues if moving assemblies (e.g. door leafs or partitions sold as a package with accompanying ironmongery and intumescent) are from outside of the UK.

Moving product into or out of Northern Ireland is potentially less straightforward. The Northern Ireland Protocol requires that goods from Great Britain (not deemed to be at risk of leaving the UK customs territory) will not pay any tariffs. However, goods ‘at risk’ of entering the EU’s single market will pay EU tariffs. From 1 January 2021, you now need to make declarations and may need to pay tariffs when bringing goods into Northern Ireland from Great Britain or from outside the EU.

Be prepared for new processes

The deal means less friction, but not frictionless trade. New paperwork requirements and changes to the VAT rules apply if you are importing or exporting products. Areas of added complexity are arrangements that span the transition deadline and it is worth double checking when the product was formally ‘placed on the market’, the legal definition and the physical placement may be different.

There are additional safeguards and hence rules and paperwork in place if you need to move goods between Northern Ireland and Great Britain and vice versa. To help here the Trader Support Service has been established www.tradersupportservice.co.uk

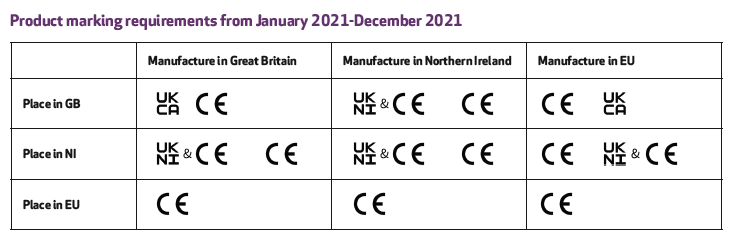

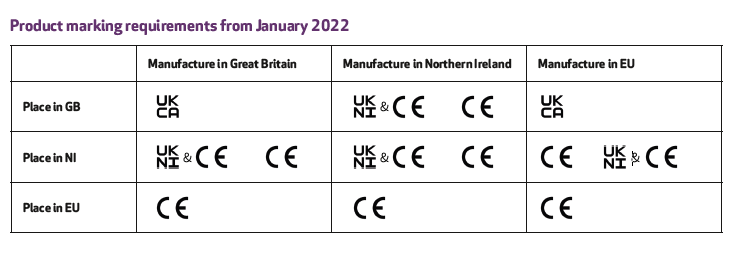

Mutual recognition and product marking

The transition on product marking has begun and we have 12 months to realign and introduce two new product marks, the UKCA and UKNI marks, which will effectively replace the CE Mark, which will no longer be accepted for placing a product on the UK market from 1 January 2022. These marks will be managed by UK-recognised approved bodies, in place of the current EU system of notified bodies. Within this change, the recognition of assessment and test reports for the purposes of CE marking where UK bodies are no longer eligible to operate as notified bodies (and vice versa EU bodies who will not be eligible to award the UKCA mark) has created some turmoil and is yet to be fully resolved.

FIS has produced some simplified tables to help explain the impact:

• You can place the UKCA and CE marking on the same product if it is destined for both the GB and EU markets so long as the product meets the rules for both markets.

• As UK notified bodies will no longer be able to provide CE marking from 1 Jan 2021, it is vital to check with your notified body how the transition is being handled.

• The UKCA mark alone cannot be used for goods placed on the market in Northern Ireland.

• So long as you have the correct approval from an EU notified and UK approved body, there is nothing to stop you using all three marks in accordance with marking requirements.

• Further clarity anticipated on how the Construction Products Regulations will be applied in Northern Ireland is available at www.gov.uk/guidance/constructionproductsregulation-in-northern-ireland

Movement of people

Another big change is the new points-based immigration system, there is no longer freedom of movement of people. Existing EU workers who lived in the UK on or before 31 December 2020 will need to apply for right to work through the Settlement Scheme. Those arriving after 1 January 2021 will need to apply for a visa and secure 70 points based on an employment offer, skill level of the role and whether they speak English and the occupational area is deemed in to be in shortage. This is particularly onerous for construction where employment is not the norm, no construction occupations are currently deemed to be in shortage and many trades are not considered sufficiently skilled to qualify for the skilled worker list.

What does it all mean?

We haven’t seen a flood of new investment off the back of greater certainty, but against the backdrop of COVID, this is not surprising. The impact on currency has been slight, the pound has strengthened modestly against the Euro, but any gain for importers is set against the impact of additional bureaucracy and the potential for some tariffs that ultimately translates into cost and inflationary pressure on products and materials. While we haven’t seen any significant supply issues (steel and timber concerns are not really Brexit-related), intermittent delays still aren’t out of the question – a missing docket could delay a shipment. Labour shortages too could impact labour rates.

The full implication of transition has yet to be understood, but there are some inflationary pressures and it is important that all companies look to isolate their risk and ensure that their contracts do not leave them carrying more than their fair share of the risk.

FIND OUT MORE

FIS has a Brexit Toolkit available at www.thefis.org/knowledge-hub/business-management/risk-register