In the final quarter of 2023, the Department for Business and Trade announced plans to make significant changes to annual leave and holiday pay laws. A response to two consultations and draft regulations were published, outlining key changes in the following areas of law: Holiday pay rates, irregular-hours and part-year workers (including rolled-up holiday pay), repeal of COVID-19 carry-over rules and holiday carry-over. For an overview of the changes, click here.

In this article, Hill Dickinson takes a more detailed look at the new options employers will have for dealing with the annual leave entitlement of irregular-hours and part-year workers, for holiday years beginning on or after 1 April 2024.

What is an irregular-hours worker?

A worker is an irregular-hours worker if, under their contract, the number of paid hours that they will work in each pay period during the term of their contract in that year is wholly or mostly variable.

This is likely to include most zero-hours workers and those workers working on casual or ‘bank worker’ contracts. However, query whether a worker whose contract requires them to work fixed hours during some parts of the year and variably in others will fall within this definition, due to the requirement that the working hours must be wholly/mostly variable ‘in each pay period’ during the term of the contract.

What is a part-year worker?

A worker is a part-year worker if, under the terms of their contract, they are required to work only part of that year and there are periods within that year (during the term of the contract) of at least a week which they are not required to work and for which they are not paid (ignoring any periods of sick leave or statutory family leave).

This is likely to include term-time only workers, exam invigilators and those who work seasonally for sports clubs. Some term-time only workers (e.g. school teachers and support staff) receive an annualised salary paid over 12-months, including during periods when they are not required to work (e.g. during school holiday periods), and there is uncertainty about whether they fall within the part-year worker definition because they are being paid during, rather than for, their non-working time.

Overview of the new rules applicable to irregular-hours and part-year workers

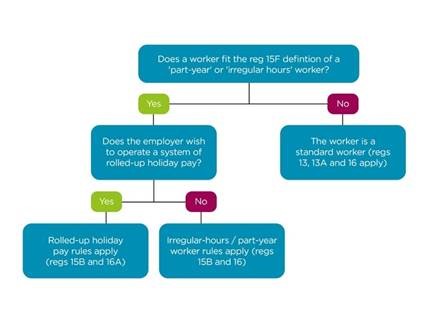

Before we delve further into the finer details of the new rules, it may be helpful to give a visual illustration of how the new regime will work for these workers, in relation to holiday years beginning on or after 1 April 2024:

As can be seen from the illustration above, an employer should first consider whether any of its workers fit the statutory definitions of irregular-hours or part-year workers.

If the answer is no, then the workers are standard workers entitled to ordinary annual leave (reg 13), additional annual leave (reg 13A) and to holiday pay calculated in accordance with regulation 16 (for our overview of the proposed changes in how this holiday pay will be calculated click here).

If the employer does have irregular-hours or part-year workers, the next consideration is whether to operate a system of rolled-up holiday pay, either in relation to all such staff or only in relation to certain categories. As explained in more detail below, there is a default entitlement for irregular-hours and part-year workers, but a different set of rules apply if a system of rolled-up holiday pay is in operation.

What are the default rules for irregular-hours and part-year workers (regs 15B/16)?

For holiday years beginning on or after 1 April 2024, irregular-hours and part-year workers will cease to be entitled to annual leave under the standard worker system of ordinary annual leave and additional annual leave (regs 13 (A1) and 13A(A1)). Instead, they will gain a new entitlement to annual leave under regulation 15B and, in summary, the following default principles will apply:

Accrual: the irregular-hours or part-year worker will accrue an entitlement to annual leave:

-

- On the last day of each pay period at the rate of 12.07% of the number of hours that they have worked during that pay period; and

- During any period of sick leave (i.e. absence from work due to sickness or injury) or maternity/adoption leave, paternity leave, shared parental leave, parental leave or parental bereavement leave (using a complex set of accrual rules based on a 52-week average set out in reg 15C).

Maximum entitlement: in any leave year, the irregular-hours or part-year worker cannot accrue more than 28 days statutory annual leave (although they may have a greater contractual entitlement).

Carry-over: the new rules will allow irregular-hours and part-year workers to carry untaken holiday over to the next leave year in the following specified situations:

- Where a worker was unable to take holiday due to being on maternity/adoption leave, paternity leave, shared parental leave, parental leave, carer’s leave or parental bereavement leave;

- Where a worker was unable to take holiday due to sick leave (i.e. absence from work due to sickness or injury);

- Where the employer has failed to recognise a right to holiday, or a right to paid holiday;

- Where the employer has failed to give the worker a reasonable opportunity to take holiday, or has failed to encourage them to do so; and/or

- Where the employer fails to inform the worker that holiday not taken will be lost at the end of the leave year.

Holiday pay rate: irregular-hours and part-year workers will be entitled, by default, to holiday pay based on the new calculations used for ordinary (reg 13 leave) for the entirety of their leave entitlement (up to the 28-day statutory maximum). This means that, to the extent it does not already do so, their holiday pay must now include:

- Payments, including commission payments and performance-related bonuses, which are intrinsically linked to the performance of tasks which a worker is obliged to carry out under the terms of their contract;

- Payments for professional or personal status relating to length of service, seniority or professional qualifications; and

- Other payments, such as overtime payments, which have been regularly paid to a worker in the 52 weeks preceding the calculation date.

This is potentially more generous than for standard workers, whose pay can be limited to basic pay plus guaranteed overtime for the 8-days’ additional leave under reg 13A.

What rules will apply if the employer operates a system of rolled-up holiday pay (regs 15B/16A)?

As an alternative, the employer can choose to operate a system of rolled-up holiday pay for irregular-hours and part-year workers. If they do so, in summary, the default rules regarding their entitlement are varied so that the following principles will apply:

Entitlement to roll-up holiday pay based on 12.07% uplift on remuneration: instead of being entitled to holiday pay at the time they take annual leave, the irregular-hours or part-year worker who is paid rolled-up holiday pay will be entitled to a 12.07% uplift to their ‘remuneration’ for work done. For these purposes, ‘remuneration’ includes all types of payments that are included when calculating holiday pay under the standard worker/default rules (outlined above). In practical terms, this means that that the 12.07% uplift does not merely apply to the basic hourly rate of pay; it will need to include certain other elements of pay, such as commission payments, performance-related bonuses intrinsically linked to the performance of tasks which a worker is obliged to carry out under the terms of their contract, regular overtime payments and any payments for professional or personal status relating to length of service, seniority or professional qualifications.

Timing of rolled-up payment: the 12.07% uplift for rolled-up holiday pay must be paid at the same time as the worker’s remuneration for work done.

Payment during sickness and family leave: if the worker:

(a) is on sick leave (i.e. absence from work due to sickness or injury) or maternity/adoption leave, paternity leave, shared parental leave, parental leave, carer’s leave or parental bereavement leave; and

(b) they were paid rolled-up holiday pay before that leave started;

then they must continue to be paid rolled-up holiday pay during the period of sick leave or family leave (based on a 52-week average).

It appears that they can still carry-forward the annual leave they accrue during that period of leave, but lose the right to be paid in respect of it.

Payslips must record rolled-up holiday pay: the worker’s payslip must indicate the amount of rolled-up holiday pay that has been paid during the relevant pay period.

Varying contracts to implement a new annual leave system

Employers of irregular-hours and/or part-year workers should consider how they intend to proceed – using the default rules, rolled-up holiday pay or a combination of the two for different groups of workers. Once decisions have been made regarding which system(s) will operate, in due course, it may be necessary to amend staff handbooks, holiday policies and any contracts of employment used for such workers.

Hill Dickinson is currently offering low cost, fixed-fee, audits to help businesses audit their compliance with the new annual leave rules.

Important note: The above analysis is based on the Working Time Regulations 1998 (as amended by the Employment Rights (Amendment, Revocation and Transitional Provision) Regulations 20231.

Source